Village Savings and Loans (VSLAs)

Most rural areas don’t have banks.

Only 3% of rural communities access any kind of financial services, and these are mainly informal village savings and loans systems.

Most rural families don’t have savings.

That makes them vulnerable to shocks, like sudden medical costs. It also means they can’t access formal credit to invest in income generating opportunities.

Financial services are vital to help rural families out of poverty. Village Savings and Loans are an ingenious system which provide the mechanism and motivation to save. It makes it possible for even the poorest families to make very small savings each week and access loans. For these families, the VSLAs are a lifeline.

VSLAs meet profound local needs in rural communities and they grow organically.

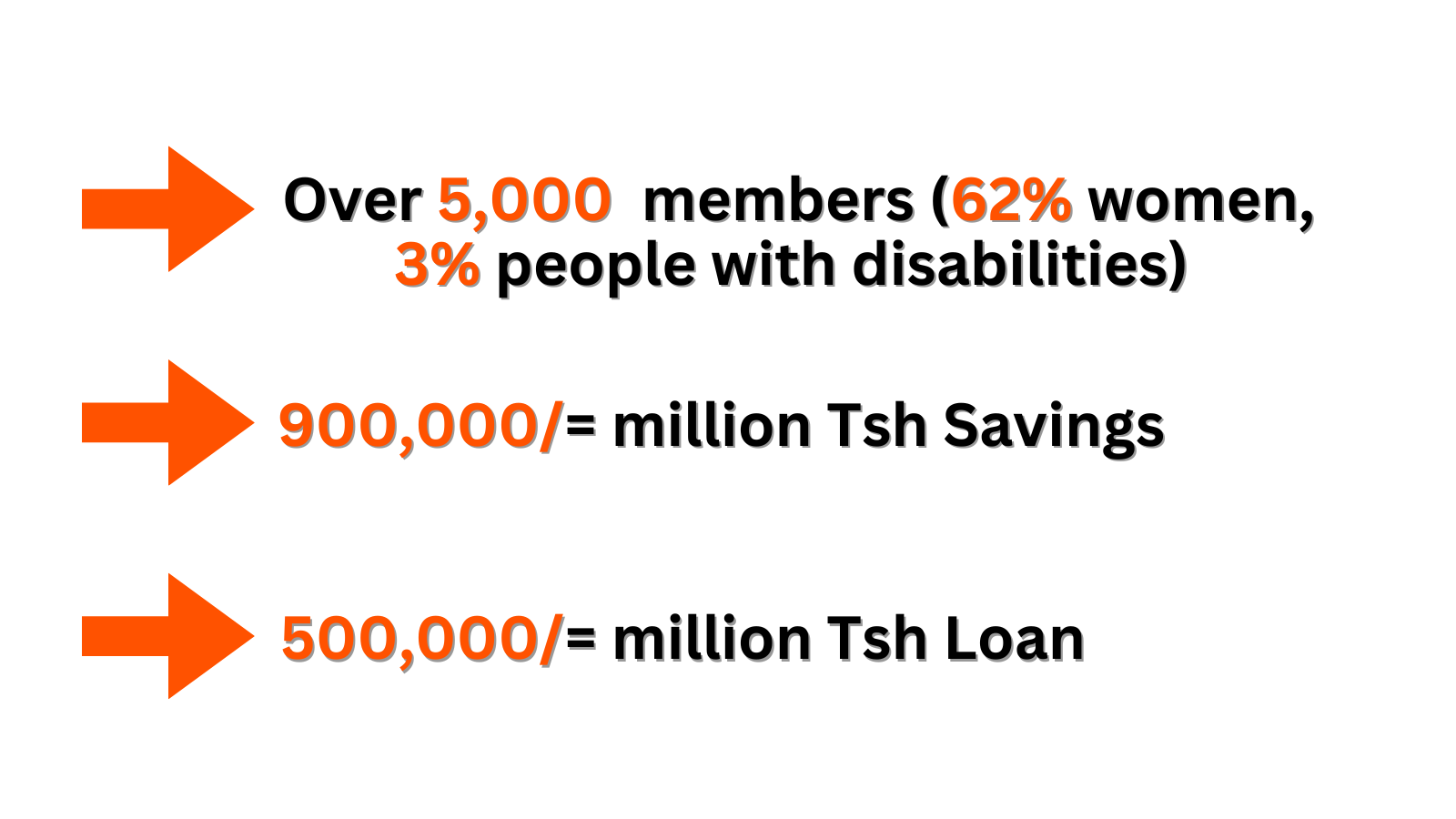

Lyra has adopted a well-established model from Care International since 2012. Community members learn how to manage their savings and access loans which they use for developing their businesses and investing in agriculture. Due to financial success of existing groups, new members were attracted to join. With minimal training and support, Lyra created 213 VSLAs groups across 3 District of Iringa (Kilolo, Iringa Rural and Mufindi District. Expertise builds within the network. Experienced VSLA members train and mentor new groups. We think the results speak for themselves.

GROWTH IN MEMBERS AND TOTAL USD SAVINGS 2012-2016

AVERAGE USD SAVINGS 2012-2020

Total assets grew from $352,756 to $406,297 throughout 2019, with total savings of $348,477 and $217,528 loaned out to members.

MEET OUR VILLAGE BANKERS

"Through the VSLA, I’ve built my own house, and sent my children to school. I started my mobile banking business, and planted 8 acres of pine and eucalyptus trees as future investment for my children. Through VSLA we walk together and we’ll reach far."

"The first year, I bought a bed and a mattress! The next year I bought a sewing machine and fabric and started my tailoring business. Joining the group really speeds up our development."

"VSLA changed my life. I can now eat what I want and cover my family’s expenses. For three years, I’ve been borrowing to buy and sell timber, and building up my business. NowI’ma major timber agent in the village, supplying over 10 bulk timber buyers. Next I plan to start my own timber yard in Iringa."

“I joined the VSLA programme immediately after introduced to the village in July 2014, In the first cycle I managed to save and borrowed Tsh 500,000 to expand my maize production. Working with traditional and trained skills in maize farming techniques, I knew that I will be able to repay back the loan with interest on time.”

"Before the VSLA, only short-term loans with high interest rates were available, which were hard to pay back. Thank you Lyra for this wonderful programme."

"I bought a bed, mattress and sofa, renovated my house and sent my younger brother to school when my parents couldn’t pay for him. All these successes were because of HISA."

"First I only sold five plates of food and 10 cups of tea a day in my little restaurant. I was worried about borrowing, but my friends encouraged me and I borrowed $50 to provide different foods. Then I was getting 20 customers a day and doubled my daily profit! I took a second loan and now I’ve got assets of $500."

"Other savings schemes in the area failed, but after our group finished the year successfully, I learned to trust it. I borrowed to invest in tailoring and got so many customers. The VSLA made everything possible for me. It helps me feed my family without depending on my husband and brings financial confidence to many women in the village."

HOW DO VILLAGE SAVINGS AND LOANS WORK?

1. AFFORDABLE

• There are no management costs for members, groups are self governed.

• All interest is returned to group members.

• The only set-up cost is a lockable box.

2. ACCESSIBLE

• Groups can be set up anywhere.

• Members find motivated friends and neighbours to form the group, meet regularly to make weekly savings.

• Group rules are simple so anyone can understand.

• Savings are recorded as a number of shares, and stamped in a passbook – so non-literate members can also use the system.

• The share system also makes it easier to calculate interest and each members' share when cash is re-distributed at the end of the cycle.

3. FLEXIBLE

• The group sets the interest rates for savers and borrowers, and the share price.

• Members can save and borrow different amounts according to their needs by buying multiple shares.

• But also as the group's overall financial capability increases, Lyra has seen group share prices rising as all members have been able to save more.

4. SUSTAINABLE

• Only the amount of cash saved in the scheme can be loaned out, to reduce the risk of group bankruptcy.

• Groups do not receive any external financing. Loans are linked to the amount of savings, to prevent members borrowing more than they can afford to repay.

5. SOCIAL BENEFITS

• VSL members invest a portion of weekly savings in a social fund to help each other in time of crisis e.g. emergency medical or funeral expenses.

• Members say being involved increases their self-respect and value in the community.